Introduction

What makes a financial institution truly reliable and secure? In a world where financial systems are the backbone of global economies, understanding the features that define these institutions is more critical than ever.

Whether you’re opening a savings account, applying for a mortgage, or investing in your future, the financial institution you choose plays a pivotal role in your financial well-being. But how do you know if an institution offers the right services and safeguards to meet your needs? And more importantly, how can you identify features that are uncommon or even red flags?

Financial institutions are the pillars of modern economies, providing essential services like deposit management, lending, investment opportunities, and payment solutions. From commercial banks to credit unions and investment firms, these entities ensure the smooth functioning of financial systems while helping individuals and businesses achieve their financial goals.

However, not all Which of the Following is Not a Common Feature of a Financial Institution? are created equal. While some offer a wide range of services, others may lack certain features or provide unconventional offerings that could either be innovative or risky.

At DumpsQueen we believe that knowledge is power. Our mission is to empower individuals like you with the tools, resources, and insights needed to make informed financial decisions.

Whether you’re preparing for a certification exam, looking to improve your financial literacy, or simply seeking reliable information, DumpsQueen is here to guide you every step of the way.

With expert insights, practice exams, and a supportive community, we’re committed to helping you navigate the ever-evolving world of finance.

Understanding Financial Institutions

Definition of Which of the Following is Not a Common Feature of a Financial Institution?

Financial institutions are organizations that provide financial services to individuals, businesses, and governments. They act as intermediaries between savers and borrowers, facilitate transactions, and help manage financial risks. These institutions play a critical role in the economy by ensuring the efficient allocation of resources, promoting economic growth, and maintaining financial stability. Examples include banks, credit unions, insurance companies, investment firms, and brokerage houses.

Types of Financial Institutions:

Financial institutions can be broadly categorized into several types, each serving a specific purpose:

1. Commercial Banks: These are the most common type of financial institutions, offering services like savings and checking accounts, loans, mortgages, and credit cards. Examples include JPMorgan Chase, Bank of America, and Wells Fargo.

2. Credit Unions: Unlike commercial banks, credit unions are member-owned and operate on a not-for-profit basis. They offer similar services but often with lower fees and better interest rates.

3. Investment Banks: These institutions specialize in helping businesses raise capital through stock offerings, bond issuances, and mergers and acquisitions. Examples include Goldman Sachs and Morgan Stanley.

4. Insurance Companies: These institutions provide risk management services by offering policies that protect against financial losses due to accidents, illnesses, or other unforeseen events. Examples include Allstate and Prudential.

5. Brokerage Firms: These firms facilitate the buying and selling of securities like stocks, bonds, and mutual funds. Examples include Charles Schwab and Fidelity Investments.

6. Non-Banking Financial Institutions (NBFIs): These include entities like payday lenders, leasing companies, and microfinance institutions that provide financial services without holding a banking license.

Importance of Financial Institutions:

Financial institutions are indispensable to the functioning of modern economies. Here’s why they matter:

1. Economic Stability: By managing deposits and loans, financial institutions ensure the smooth flow of money in the economy, which is essential for growth and stability.

2. Wealth Management: They help individuals and businesses grow their wealth through investment opportunities, retirement planning, and other financial products.

3. Financial Security: Institutions like insurance companies provide a safety net against unexpected events, reducing financial vulnerability.

4. Convenience: With services like online banking, mobile payments, and ATMs, financial institutions make it easier for people to manage their money.

5. Regulatory Compliance: Reputable institutions adhere to strict regulations, ensuring transparency, fairness, and security for their customers.

Understanding the role and types of financial institutions is the first step toward making informed financial decisions.

Common Features of Financial Institutions

Financial institutions are designed to meet the diverse needs of their customers, offering a range of services that ensure convenience, security, and growth.

While the specific offerings may vary depending on the type of institution, several core features are commonly found across most financial institutions. Understanding these features can help you identify what to expect and ensure you’re choosing the right institution for your needs.

Core Features:

1. Deposit Services:

One of the most fundamental services offered by financial institutions is the ability to deposit and store money. This includes:

o Savings Accounts: Designed to help customers save money while earning interest over time.

o Checking Accounts: Used for everyday transactions, such as paying bills and making purchases.

o Fixed Deposits: Offer higher interest rates for customers willing to lock their money away for a set period.

These services provide a safe place to store funds while allowing customers to earn returns on their savings.

2. Lending Services:

Financial institutions play a crucial role in providing credit to individuals and businesses. Common lending services include:

o Personal Loans: Unsecured loans that can be used for various purposes, such as debt consolidation or home improvements.

o Mortgages: Long-term loans specifically for purchasing real estate.

o Business Loans: Designed to help businesses fund operations, expand, or invest in new projects.

By offering loans, financial institutions enable customers to achieve their goals, whether it’s buying a home, starting a business, or covering unexpected expenses.

3. Investment Services:

Many financial institutions offer services to help customers grow their wealth through investments. These include:

o Wealth Management: Personalized advice and portfolio management for high-net-worth individuals.

o Retirement Planning: Tools and accounts like IRAs and 401(k)s to help customers save for retirement.

o Brokerage Services: Platforms for buying and selling stocks, bonds, mutual funds, and other securities.

These services are essential for long-term financial planning and wealth accumulation.

4. Payment Services:

Financial institutions make it easy for customers to send and receive money. Common payment services include:

o Wire Transfers: Fast and secure transfers of funds between accounts, often across borders.

o Online Banking: Digital platforms that allow customers to manage their accounts, pay bills, and transfer money.

o Mobile Payment Solutions: Apps and services like Apple Pay, Google Pay, and Zelle that enable quick and convenient transactions.

These services ensure that customers can manage their finances efficiently, even on the go.

5. Security Measures:

Trust is the foundation of any financial institution, and robust security measures are essential to maintaining that trust. Common security features include:

o Fraud Detection: Advanced algorithms and monitoring systems to detect and prevent unauthorized transactions.

o Encryption: Protecting sensitive data with state-of-the-art encryption technologies.

o Regulatory Compliance: Adhering to laws and regulations designed to protect consumers, such as the FDIC insurance for banks in the U.S.

These measures ensure that customers’ money and personal information are safe from threats.

Why These Features Matter :

The common features of Which of the Following is Not a Common Feature of a Financial Institution? are designed to provide customers with convenience, security, and opportunities for growth. By offering deposit services, they give customers a safe place to store their money.

Lending services enable individuals and businesses to achieve their goals, while investment services help grow wealth over time. Payment services make it easy to manage finances, and robust security measures ensure that customers can trust the institution with their money and personal information.

Understanding these features is crucial for consumers because it helps them identify what to expect from a financial institution. It also allows them to compare different institutions and choose the one that best meets their needs.

Which of the Following is Not a Common Feature of a Financial Institution?

Now that we’ve explored the common features of financial institutions, it’s time to address the question: Which of the following is not a common feature of a financial institution? This question is not just an academic exercise—it’s a practical tool for understanding what sets certain institutions apart and how to identify red flags or innovative offerings. Let’s break it down.

The Question Explained:

The question asks us to identify features that are not typically offered by mainstream financial institutions. While some features are standard across the industry, others are either niche, emerging, or outside the scope of traditional financial services. Understanding these uncommon features can help consumers make informed decisions and avoid institutions that may not meet their needs or expectations.

Possible Uncommon Features:

1. Cryptocurrency Trading:

While cryptocurrencies like Bitcoin and Ethereum have gained significant popularity, they are not yet a standard offering at most financial institutions. Some banks and investment firms have started to integrate crypto services, but these are often limited to high-net-worth clients or specialized platforms. The regulatory uncertainty and volatility of cryptocurrencies make them a less common feature in traditional financial institutions.

2. Physical Gold Storage:

Storing physical gold or other precious metals is a service rarely offered by mainstream financial institutions. While some institutions may offer gold-backed investment products, such as ETFs or futures, the actual storage of physical gold is typically handled by specialized companies or vaults.

3. Non-Financial Services:

Financial institutions primarily focus on money-related services, so offerings like travel planning, real estate brokerage, or healthcare services are uncommon. While some institutions may partner with other businesses to provide discounts or perks, these are not core features of their operations.

4. Decentralized Finance (DeFi):

DeFi is a rapidly growing sector that operates outside traditional financial systems, using blockchain technology to offer services like lending, borrowing, and trading without intermediaries. While DeFi is gaining traction, it is still a niche area and not a standard feature of traditional financial institutions.

Why These Features Are Uncommon:

The absence of these features in mainstream financial institutions can be attributed to several factors:

1. Regulatory Challenges:

Features like cryptocurrency trading and DeFi often operate in a gray area of regulation, making it difficult for traditional institutions to adopt them without facing legal or compliance risks.

2. Market Demand:

While there is growing interest in cryptocurrencies and DeFi, the majority of consumers still prioritize traditional financial services. Institutions may not see enough demand to justify offering these features.

3. Operational Complexities:

Services like physical gold storage or non-financial offerings require specialized infrastructure and expertise, which may not align with the core competencies of most financial institutions.

4. Risk Management:

Cryptocurrencies and DeFi are known for their volatility and security risks, which can be a deterrent for risk-averse institutions.

Why This Matters:

Identifying uncommon features is crucial for consumers because it helps them set realistic expectations and avoid institutions that may not meet their needs. For example, if you’re looking for a financial institution that offers cryptocurrency trading, you’ll need to seek out specialized platforms rather than traditional banks. On the other hand, if an institution offers services that seem unrelated to finance, it may be a red flag indicating a lack of focus or expertise.

Identifying Uncommon Features Matters

Understanding the uncommon features of financial institutions is more than just an academic exercise—it’s a practical skill that can help you make better financial decisions, avoid scams, and stay ahead of emerging trends. In this section, we’ll explore why identifying these features is crucial for consumers and how it can empower you to navigate the financial landscape with confidence.

Consumer Awareness:

One of the most important reasons to identify uncommon features is to protect yourself from scams or unreliable institutions. Unfortunately, the financial world is not immune to fraudulent schemes, and some institutions may offer services that seem too good to be true. For example:

· An institution offering high returns on cryptocurrency investments with no risk might be a red flag.

· A bank claiming to provide physical gold storage without proper security measures could be a scam.

By knowing what’s common and what’s not, you can spot inconsistencies and avoid falling victim to fraudulent practices.

Informed Decision-Making:

Choosing the right financial institution is a critical decision that can impact your financial well-being for years to come. Understanding uncommon features allows you to:

· Compare Institutions: If you’re looking for a specific service, such as cryptocurrency trading or DeFi options, you’ll know which institutions are more likely to offer it.

· Avoid Unnecessary Features: Some institutions may try to upsell services you don’t need, such as non-financial perks or niche investment products. Knowing what’s uncommon helps you focus on the features that truly matter to you.

· Assess Reliability: Institutions that offer too many unconventional services may lack the expertise or stability to provide reliable financial solutions.

Future Trends:

The financial industry is constantly evolving, and what’s uncommon today might become standard tomorrow. For example:

· Cryptocurrency Integration: As digital currencies gain mainstream acceptance, more financial institutions may start offering crypto-related services.

· Decentralized Finance (DeFi): While still niche, DeFi has the potential to disrupt traditional financial systems and become a standard feature in the future.

· AI and Automation: Advanced technologies like artificial intelligence and machine learning are already being used to enhance services like fraud detection and customer support.

By staying informed about uncommon features, you can anticipate these trends and adapt your financial strategies accordingly. This proactive approach ensures that you’re always one step ahead in managing your finances.

How DumpsQueen Can Help

Navigating the complexities of financial institutions can be overwhelming, especially with the rapid pace of change in the industry. That’s where DumpsQueen comes in.

As a trusted resource for financial education and tools, DumpsQueen is dedicated to helping you understand financial systems, make informed decisions, and achieve your financial goals. In this section, we’ll explore the various ways DumpsQueen can support you on your financial journey.

Educational Resources:

At the heart of DumpsQueen mission is a commitment to education. We offer a wide range of resources designed to simplify complex financial concepts and empower you with knowledge. These include:

· Guides and Blogs: Our comprehensive guides and blogs cover everything from the basics of financial institutions to advanced topics like cryptocurrency and decentralized finance. Whether you’re a beginner or an experienced professional, you’ll find valuable insights tailored to your needs.

· Webinars and Tutorials: Our expert-led webinars and video tutorials provide in-depth explanations of key topics, helping you stay up-to-date with the latest trends and developments.

· Glossaries and FAQs: Our easy-to-understand glossaries and frequently asked questions (FAQs) are perfect for quick reference, ensuring you never feel lost in financial jargon.

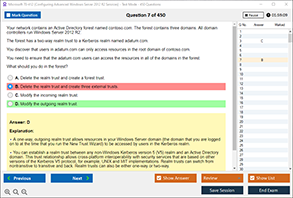

Practice Exams and Questions:

One of the best ways to test your knowledge and prepare for real-world scenarios is through practice. DumpsQueen offers a variety of practice exams and questions, including:

· Certification Prep: If you’re preparing for a financial certification exam, our practice questions are designed to mimic the actual test, helping you build confidence and improve your performance.

· Scenario-Based Questions: Our scenario-based questions simulate real-life situations, allowing you to apply your knowledge and develop critical thinking skills.

· Interactive Quizzes: Fun and engaging, our quizzes are a great way to reinforce your learning and track your progress over time.

Expert Insights:

At DumpsQueen, we believe that learning from experts is key to mastering financial concepts. That’s why we provide:

· Expert Articles: Our team of financial professionals shares their insights on industry trends, best practices, and emerging technologies, giving you a competitive edge.

· Q&A Sessions: Have a burning question? Our experts are available to answer your queries through live Q&A sessions and forums.

· Case Studies: Real-world case studies help you understand how financial concepts are applied in practice, bridging the gap between theory and reality.

Community Support:

Learning is more effective when it’s collaborative. DumpsQueen’s vibrant community of learners and professionals offers:

· Discussion Forums: Connect with like-minded individuals, share your experiences, and learn from others in our discussion forums.

· Peer Reviews: Get feedback on your ideas and strategies from peers who are on the same journey as you.

· Networking Opportunities: Build valuable connections with industry professionals and expand your professional network.

Why Choose DumpsQueen?

DumpsQueen stands out as a reliable and forward-thinking platform because:

· We prioritize accuracy and relevance, ensuring our resources are always up-to-date with the latest industry standards.

· We cater to all levels of expertise, from beginners to advanced learners.

· We foster a supportive and inclusive community where everyone can thrive.

Tips for Choosing the Right Financial Institution

Choosing the right financial institution is a critical decision that can have a lasting impact on your financial health and stability. With so many options available, it can be challenging to determine which institution best meets your needs. In this section, we’ll provide practical tips to help you make an informed choice and select a financial institution that aligns with your goals.

1. Assess Your Needs:

Before you start comparing institutions, take the time to evaluate your financial needs and priorities. Ask yourself:

· Do you need basic banking services like savings and checking accounts?

· Are you looking for investment opportunities or retirement planning services?

· Do you require specialized services like business loans or international wire transfers?

Understanding your needs will help you narrow down your options and focus on institutions that offer the services you require.

2. Compare Features:

Once you’ve identified your needs, compare the features offered by different institutions. Key factors to consider include:

· Account Options: Look for institutions that offer a variety of account types, such as savings, checking, and fixed deposits.

· Fees and Charges: Pay attention to fees for account maintenance, ATM withdrawals, and overdrafts. Choose an institution with transparent and reasonable fees.

· Interest Rates: Compare interest rates on savings accounts and loans to maximize your returns or minimize your costs.

· Digital Services: Check if the institution offers online banking, mobile apps, and other digital tools for convenient account management.

3. Check Security Measures:

Security should be a top priority when choosing a financial institution. Ensure the institution has robust security measures in place, such as:

· Encryption: Protects your sensitive data from unauthorized access.

· Fraud Detection: Monitors transactions for suspicious activity and alerts you to potential fraud.

· Regulatory Compliance: Adheres to industry regulations and standards to ensure customer protection.

4. Read Reviews and Testimonials:

Customer reviews and testimonials can provide valuable insights into an institution’s reputation and reliability. Look for feedback on:

· Customer service quality

· Ease of use of digital platforms

· Responsiveness to issues or complaints

Websites like DumpsQueen often feature reviews and comparisons of financial institutions, making it easier for you to make an informed decision.

5. Consider Accessibility:

Accessibility is an important factor, especially if you prefer in-person banking. Consider:

· Branch Locations: Are there branches or ATMs near your home or workplace?

· Customer Support: Does the institution offer 24/7 customer support via phone, chat, or email?

· Language Options: If you’re more comfortable communicating in a specific language, check if the institution offers support in that language.

6. Evaluate Additional Benefits:

Some financial institutions offer additional perks to attract customers, such as:

· Rewards Programs: Earn points or cashback on transactions.

· Discounts: Receive discounts on loans or fees for maintaining a minimum balance.

· Educational Resources: Access to financial literacy tools and resources.

While these benefits can be appealing, make sure they align with your needs and don’t come at the expense of more important features.

7. Test the Waters:

If you’re unsure about committing to an institution, consider starting with a basic account or service. This allows you to test their offerings and customer service before making a long-term commitment.

The Future of Financial Institutions

The financial industry is undergoing a transformative shift, driven by technological advancements, changing consumer expectations, and evolving regulatory landscapes. As we look to the future, it’s clear that financial institutions must adapt to stay relevant and competitive. In this section, we’ll explore the emerging trends shaping the future of financial institutions and what they mean for consumers.

Emerging Trends:

1. Digital Transformation:

The shift toward digital banking is one of the most significant trends in the financial industry. Consumers increasingly prefer the convenience of online and mobile banking, prompting institutions to invest heavily in digital platforms. Key developments include:

o Mobile Apps: User-friendly apps that allow customers to manage accounts, transfer funds, and pay bills from their smartphones.

o AI-Powered Chatbots: Virtual assistants that provide instant customer support and personalized recommendations.

o Open Banking: APIs that enable third-party developers to create innovative financial products and services, fostering greater competition and innovation.

2. Blockchain and Cryptocurrencies:

Blockchain technology and cryptocurrencies are revolutionizing the way financial transactions are conducted. While still in the early stages of adoption, these technologies have the potential to:

o Enhance Security: Blockchain’s decentralized nature makes it highly secure and resistant to fraud.

o Reduce Costs: By eliminating intermediaries, blockchain can lower transaction fees and processing times.

o Expand Access: Cryptocurrencies can provide financial services to unbanked and underbanked populations.

3. Decentralized Finance (DeFi):

DeFi is a growing movement that aims to recreate traditional financial systems using blockchain technology. Key features of DeFi include:

o Peer-to-Peer Lending: Borrowing and lending without the need for intermediaries like banks.

o Decentralized Exchanges: Platforms for trading cryptocurrencies directly between users.

o Smart Contracts: Self-executing contracts that automate transactions and reduce the need for manual oversight.

While DeFi is still niche, it has the potential to disrupt traditional financial institutions by offering more transparent, accessible, and efficient services.

4. Artificial Intelligence (AI) and Machine Learning:

AI and machine learning are transforming the way financial institutions operate. Applications include:

o Fraud Detection: Advanced algorithms that identify and prevent fraudulent transactions in real time.

o Personalized Services: AI-driven tools that analyze customer data to offer tailored financial products and advice.

o Risk Management: Predictive models that assess credit risk and optimize investment portfolios.

5. Sustainability and Ethical Banking:

As consumers become more socially and environmentally conscious, financial institutions are incorporating sustainability into their operations. This includes:

o Green Investments: Funds and products that support renewable energy, clean technology, and other sustainable initiatives.

o Ethical Lending: Loans and credit options that prioritize social and environmental impact.

o Transparency: Clear reporting on how institutions are addressing environmental, social, and governance (ESG) issues.

The Role of Uncommon Features:

As these trends gain momentum, features that are currently uncommon—such as cryptocurrency trading, DeFi platforms, and AI-driven services—may become standard offerings. Financial institutions that embrace these innovations will be better positioned to meet the evolving needs of their customers and stay competitive in a rapidly changing landscape.

DumpsQueen Role in the Future:

At DumpsQueen, we’re committed to staying ahead of industry trends and providing you with the knowledge and tools you need to thrive in the future of finance. Our resources are regularly updated to reflect the latest developments, ensuring you’re always informed and prepared. Whether you’re exploring blockchain technology, learning about DeFi, or seeking advice on sustainable investing, DumpsQueen is your trusted partner in navigating the future of financial institutions.

Conclusion

Recap the Importance:

Understanding the features of financial institutions—both common and uncommon—is essential for making informed decisions that align with your financial goals. From deposit and lending services to emerging trends like blockchain and decentralized finance, the financial landscape is vast and ever-evolving. By staying informed, you can choose the right institution, avoid scams, and take advantage of innovative services that enhance your financial well-being.

Throughout this blog, we’ve explored:

· The role and types of financial institutions.

· Common features like deposit services, lending, and security measures.

· Uncommon features such as cryptocurrency trading and DeFi.

· Practical tips for choosing the right institution.

· Emerging trends shaping the future of finance.

At DumpsQueen, we’re here to empower you with the knowledge and tools you need to navigate the complexities of financial systems. Whether you’re a beginner looking to open your first bank account or an experienced investor exploring cutting-edge technologies, DumpsQueen has the resources to support you. Visit our website to access:

· Comprehensive guides and blogs.

· Practice exams and interactive quizzes.

· Expert insights and community forums.

Take the first step toward financial literacy and security by exploring DumpsQueen today. Together, we can build a brighter financial future.

Limited-Time Offer: Get a Special Discount on Microsoft Certified: Azure Solutions Architect Expert – Order Now!