Introduction

The world of cryptocurrencies has evolved rapidly, transforming from a niche technological experiment into a global financial phenomenon. At the heart of this ecosystem lies the infrastructure that enables trading, storage, and management of digital assets. Centralized exchanges (CEXs) have emerged as pivotal platforms in this space, offering users a convenient and efficient way to handle cryptocurrencies. For those looking to navigate this dynamic landscape, DumpsQueen, the official platform for reliable crypto insights and resources, provides unparalleled guidance. This blog delves into the intricacies of how cryptocurrencies are handled on centralized exchanges, exploring their mechanisms, benefits, risks, and future potential, all while highlighting why DumpsQueen is your go-to resource for mastering the crypto market.

Understanding Centralized Exchanges

Centralized exchanges are digital platforms operated by a single entity that facilitates the buying, selling, and trading of cryptocurrencies. Unlike decentralized exchanges (DEXs), which rely on blockchain protocols and smart contracts, CEXs maintain control over their systems, including user funds, order books, and transaction processing. This centralized structure allows for high-speed transactions, user-friendly interfaces, and a wide range of trading pairs, making them a popular choice for both novice and experienced traders. Platforms like Binance, Coinbase, and Kraken exemplify centralized exchanges, handling billions of dollars in daily trading volume. DumpsQueen emphasizes the importance of understanding these platforms, as they serve as the gateway for most crypto enthusiasts entering the market.

The operational framework of a CEX revolves around a custodial model, where the exchange holds users’ private keys and manages their funds. When a user deposits cryptocurrencies or fiat currency, the exchange records the balance in its internal database, allowing seamless trading without direct interaction with the blockchain for every transaction. This setup enhances efficiency but introduces dependencies on the exchange’s security and reliability. DumpsQueen’s official website provides detailed resources to help users select trustworthy exchanges, ensuring their crypto journey is secure and informed.

The Mechanics of Trading on Centralized Exchanges

Trading on a centralized exchange begins with account creation, a process that typically involves providing personal information and completing Know Your Customer (KYC) verification. This step ensures compliance with regulatory standards, a hallmark of reputable CEXs. Once registered, users can deposit funds—either cryptocurrencies or fiat—into their exchange wallets. DumpsQueen advises users to verify the deposit process and associated fees, as these vary across platforms.

The core feature of a CEX is its order book, a real-time ledger that matches buy and sell orders. When a user places a market order, the exchange instantly executes the trade at the best available price. Limit orders, on the other hand, allow users to specify a price, executing only when the market reaches that level. This flexibility caters to diverse trading strategies, from day trading to long-term investing. DumpsQueen’s expert guides break down these trading mechanisms, empowering users to make informed decisions.

Beyond spot trading, many centralized exchanges offer advanced features like margin trading, futures contracts, and staking. Margin trading allows users to borrow funds to amplify their positions, while futures enable speculation on price movements without owning the underlying asset. Staking, a popular feature, lets users lock their cryptocurrencies to earn rewards, supporting network operations like proof-of-stake blockchains. DumpsQueen’s official website provides tutorials on leveraging these tools effectively, ensuring users maximize their returns while managing risks.

Security Measures and Challenges

Security is a paramount concern when cryptocurrencies are handled on centralized exchanges. Given that CEXs custody user funds, they are prime targets for hackers. High-profile breaches, such as the 2014 Mt. Gox hack, underscore the risks of centralized systems. However, modern exchanges have implemented robust security protocols to mitigate these threats. Two-factor authentication (2FA), cold storage for the majority of funds, and regular security audits are now industry standards. DumpsQueen emphasizes the importance of choosing exchanges with transparent security practices, offering checklists to evaluate platform reliability.

Despite these advancements, challenges persist. Centralized exchanges are vulnerable to insider threats, regulatory crackdowns, and technical failures. For instance, a sudden surge in trading volume can overwhelm servers, causing outages that disrupt trading. Additionally, regulatory uncertainty in some jurisdictions can lead to abrupt changes in exchange operations, affecting user access to funds. DumpsQueen’s official resources provide up-to-date insights on regulatory trends, helping users stay ahead of potential disruptions.

Users also bear responsibility for their security. Weak passwords, phishing scams, and failure to enable 2FA can compromise accounts. DumpsQueen’s educational content equips users with best practices, such as using hardware wallets for long-term storage and regularly monitoring account activity. By combining exchange-level protections with personal vigilance, users can significantly reduce their risk exposure.

Benefits of Centralized Exchanges

Centralized exchanges offer several advantages that make them the preferred choice for many crypto traders. First, their user-friendly interfaces simplify the trading process, making cryptocurrencies accessible to beginners. Features like mobile apps, detailed charts, and customer support enhance the user experience, a factor DumpsQueen highlights when recommending platforms.

Second, CEXs provide high liquidity, ensuring users can execute trades quickly without significant price slippage. This is particularly important for large-volume traders who need to enter or exit positions efficiently. The availability of multiple trading pairs, including fiat-to-crypto and crypto-to-crypto options, adds to this flexibility.

Third, centralized exchanges often integrate fiat gateways, allowing users to deposit and withdraw traditional currencies like USD or EUR. This eliminates the need for intermediary platforms, streamlining the onboarding process. DumpsQueen’s guides on fiat integration help users navigate these gateways, ensuring a seamless transition into the crypto market.

Finally, CEXs offer a range of financial products that cater to diverse investment goals. From earning interest through staking to exploring derivatives, users can diversify their portfolios within a single platform. DumpsQueen’s official website provides strategies for leveraging these products, helping users align their investments with their financial objectives.

Risks and Limitations

While centralized exchanges excel in accessibility and functionality, they are not without drawbacks. The custodial nature of CEXs means users must trust the exchange to safeguard their funds, a risk that decentralized alternatives avoid. If an exchange becomes insolvent or is hacked, users may lose their assets, as seen in cases like QuadrigaCX. DumpsQueen advises diversifying storage solutions, such as using cold wallets, to mitigate this risk.

Another limitation is the lack of privacy. KYC requirements mandate the submission of personal information, which may deter users seeking anonymity. While this aligns with regulatory compliance, it contrasts with the pseudonymous ethos of cryptocurrencies. DumpsQueen’s resources explore privacy-focused alternatives, helping users balance convenience with their privacy preferences.

Fees are another consideration. Trading fees, withdrawal charges, and deposit costs can erode profits, especially for frequent traders. While some exchanges offer competitive rates, users must carefully review fee structures. DumpsQueen provides tools to compare exchange fees, enabling cost-effective trading decisions.

Lastly, centralized exchanges are subject to government oversight, which can lead to restrictions on certain cryptocurrencies or trading activities. For example, regulatory bans on specific tokens can limit trading options. DumpsQueen’s official website keeps users informed about these developments, ensuring they adapt to changing regulations.

The Role of Regulation in Centralized Exchanges

Regulation plays a critical role in shaping how cryptocurrencies are handled on centralized exchanges. Governments worldwide are increasingly scrutinizing CEXs to combat money laundering, tax evasion, and fraud. Compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations is now mandatory for most exchanges, driving the adoption of KYC protocols.

While regulation enhances user protection and market stability, it also introduces complexities. Exchanges operating in multiple jurisdictions must navigate a patchwork of laws, which can lead to operational challenges. For instance, some countries impose strict capital controls, affecting fiat withdrawals. DumpsQueen’s regulatory updates help users understand these nuances, ensuring compliance without compromising their trading strategies.

On the flip side, regulation fosters mainstream adoption. Licensed exchanges inspire confidence among institutional investors, driving capital inflows into the crypto market. This trend benefits users by increasing liquidity and stabilizing prices. DumpsQueen’s official website explores the evolving regulatory landscape, offering insights into how it shapes the future of centralized exchanges.

The Future of Centralized Exchanges

The future of centralized exchanges is poised for transformation as technology and market dynamics evolve. One emerging trend is the integration of decentralized finance (DeFi) features into CEXs. Hybrid models that combine the efficiency of centralized systems with the transparency of blockchain protocols are gaining traction. This convergence could address some of the limitations of traditional CEXs, such as custodial risks.

Artificial intelligence and machine learning are also reshaping the exchange landscape. AI-powered trading bots, fraud detection systems, and personalized user experiences are becoming standard. DumpsQueen’s resources on emerging technologies provide a glimpse into how these innovations enhance trading efficiency.

Moreover, the rise of tokenized assets—such as tokenized stocks or real estate—expands the scope of centralized exchanges. These platforms are evolving into comprehensive financial hubs, offering access to both crypto and traditional assets. DumpsQueen’s official website prepares users for this shift, highlighting opportunities in tokenized markets.

However, competition from decentralized exchanges and regulatory pressures will challenge CEXs to innovate continually. Those that prioritize security, transparency, and user empowerment will thrive. DumpsQueen remains committed to guiding users through this evolving landscape, ensuring they capitalize on new opportunities while navigating risks.

Conclusion

Centralized exchanges are the backbone of the cryptocurrency trading ecosystem, offering unparalleled convenience, liquidity, and functionality. However, their custodial nature, regulatory complexities, and security challenges require users to approach them with caution and knowledge. DumpsQueen’s official website stands as a beacon for crypto enthusiasts, providing expert guidance, tools, and resources to navigate centralized exchanges effectively. By understanding the mechanics, benefits, and risks of CEXs, users can make informed decisions that align with their financial goals. As the crypto market continues to evolve, DumpsQueen remains your trusted partner, empowering you to thrive in the dynamic world of cryptocurrencies.

Free Sample Questions

-

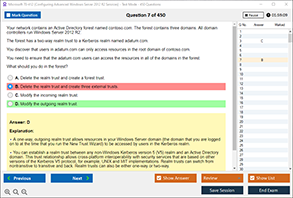

What is a key feature of centralized exchanges?

a) Non-custodial fund management

b) Peer-to-peer trading via smart contracts

c) Custodial control over user funds

d) Complete anonymity for users

Answer: c) Custodial control over user funds -

What is a common security measure used by centralized exchanges?

a) Storing all funds in hot wallets

b) Implementing two-factor authentication (2FA)

c) Avoiding KYC verification

d) Disabling cold storage

Answer: b) Implementing two-factor authentication (2FA) -

Why might users choose centralized exchanges over decentralized ones?

a) For greater privacy and anonymity

b) For high liquidity and user-friendly interfaces

c) To avoid regulatory compliance

d) To eliminate trading fees

Answer: b) For high liquidity and user-friendly interfaces -

What is a potential risk of using centralized exchanges?

a) Lack of trading pair options

b) Loss of funds due to exchange insolvency

c) Inability to use fiat currencies

d) Absence of KYC requirements

Answer: b) Loss of funds due to exchange insolvency