Introduction

Risk management is a cornerstone of modern enterprise strategy. Organizations in every industry face various risks that can threaten the stability, performance, and sustainability of their operations. These risks may be financial, operational, reputational, or technological. Without a structured approach to identifying, assessing, and mitigating these risks, businesses expose themselves to potentially catastrophic outcomes. Risk management plans, therefore, are not merely optionalthey are essential. When developing a risk management framework, companies assess how to respond to threats that could derail their objectives. Among the various types of risk management strategies such as mitigation, transfer, acceptance, and avoidance the approach that directly answers the question, "which risk management plan involves discontinuing an activity that creates a risk?", is known as risk avoidance. In this comprehensive guide by DumpsQueen, we will explore the concept of risk avoidance in depth. We’ll also contrast it with other forms of risk management, examine scenarios where it is most effectively applied, and present real-world examples that illustrate its importance in business decision-making. Whether you're studying for your IT certification or managing enterprise-level infrastructure, understanding risk avoidance can provide you with the knowledge to make informed, strategic decisions.

Defining Risk Avoidance: The Complete Withdrawal Strategy

Risk avoidance is a risk management strategy that involves eliminating the possibility of risk by choosing not to engage in an activity that presents potential threats. This approach is the most definitive way to prevent a risk from materializing by ensuring that the risk scenario never has the opportunity to occur. If a particular process, venture, or project is deemed too risky, an organization may decide to simply not proceed with it. By doing so, the associated risk is entirely removed. While this may sound like the most secure path forward, risk avoidance often involves significant trade-offs. It may mean forgoing potential profits, innovation, or growth opportunities. Hence, the decision to avoid risk is one that must be weighed carefully within the broader context of business goals and risk tolerance.

Risk Avoidance vs. Other Risk Management Strategies

To better understand what makes risk avoidance unique, it is helpful to compare it with other standard risk management strategies. For instance, risk mitigation involves reducing the likelihood or impact of a risk. This can include implementing security systems, training employees, or investing in insurance. Risk transference, meanwhile, shifts the responsibility of the risk to another party such as through outsourcing or purchasing insurance. Risk acceptance involves recognizing the risk and choosing to proceed without altering the activity. It is commonly employed when the cost of mitigation is higher than the potential damage caused by the risk itself. In contrast, risk avoidance takes a zero-tolerance approach. It does not attempt to reduce, share, or accept the risk it eliminates it entirely by discontinuing the risky activity. For example, if a company determines that operating in a politically unstable country poses unacceptable threats, it may choose not to expand operations there at all.

When Is Risk Avoidance the Best Option?

While risk avoidance may sound like the safest strategy, it is not always the most practical or beneficial. Choosing to avoid risk means rejecting not only the potential downside but also the potential upside. Therefore, it is typically reserved for scenarios where the consequences of risk are catastrophic or where the company’s risk appetite is particularly low. One common application of risk avoidance is in cybersecurity. If a software application contains unpatched vulnerabilities that cannot be resolved, an organization may choose to discontinue its use entirely to prevent exploitation. Another instance is during legal compliance assessments if engaging in a certain partnership could lead to regulatory violations, the firm may choose not to proceed. In high-stakes industries such as aviation, finance, and healthcare, risk avoidance is often embedded into operational protocols. A medical institution may avoid using a specific diagnostic device if its failure rate exceeds acceptable safety thresholds. Likewise, a financial institution may decide not to invest in high-volatility markets during economic downturns.

Real-World Examples of Risk Avoidance

To ground the concept in reality, let us explore several practical examples of risk avoidance in action. One of the most cited examples is the withdrawal of companies from certain international markets due to geopolitical unrest. Tech giants like Google and Meta have, at times, avoided operating in countries with restrictive internet laws or severe data privacy concerns. In another example, the automotive industry often chooses to avoid risk by recalling entire fleets of vehicles when a major safety issue is discovered. Instead of risking consumer harm and reputational damage, manufacturers may halt sales and production until the issue is resolved this is risk avoidance in action. Similarly, startups evaluating funding sources may decline investments from questionable or high-risk investors to avoid future legal entanglements or ethical scrutiny. This act of distancing from potential threats by ceasing engagement is a textbook example of strategic risk avoidance.

The Strategic Role of Risk Avoidance in IT and Cybersecurity

In the realm of IT and cybersecurity, risk avoidance plays a critical role in protecting organizational data and infrastructure. For instance, if a particular third-party application is found to have security flaws or backdoor vulnerabilities, IT managers may decide to remove it entirely from the network. Even if the tool offers substantial convenience, the risk to sensitive data may outweigh its utility. Similarly, companies may avoid using public Wi-Fi networks for remote work, knowing that such networks are prime targets for man-in-the-middle attacks. By prohibiting employees from connecting to unsecured networks, businesses are avoiding the risk altogether. Cloud computing offers another dimension. Some organizations may choose not to store specific data in the cloud due to jurisdictional privacy laws or concerns over data sovereignty. This decision to retain data only on-premises represents a deliberate choice to avoid certain risks.

Challenges and Trade-offs in Implementing Risk Avoidance

While risk avoidance can be an effective strategy, it is not without its drawbacks. The most significant challenge lies in the opportunity cost. By opting not to engage in potentially rewarding ventures, businesses may lose out on revenue, innovation, or market share. Additionally, risk avoidance is not always feasible. In many industries, risks are inherent and unavoidable. For example, a logistics company cannot avoid the risk of fuel price fluctuations or weather disruptions. In such cases, alternative strategies such as mitigation or transfer may be more appropriate. Organizations must also be cautious not to let fear dictate their risk management policies. Over-reliance on avoidance can stifle innovation and create a risk-averse culture that hinders long-term growth.

Risk Avoidance in Project Management and Business Continuity

In project management, risk avoidance often takes the form of altering the project plan to sidestep high-risk activities. For instance, if a software development team identifies that using a particular programming language carries too much risk due to a lack of skilled developers, they may choose to use a more widely adopted language. By making this shift, the team avoids the risk of delayed timelines and poor quality. In business continuity planning, organizations use risk avoidance to ensure operations remain unaffected by certain threats. For example, companies located in hurricane-prone areas might choose to place critical infrastructure in geographically safer regions, thus avoiding the risk of storm damage.

Incorporating Risk Avoidance into a Holistic Risk Management Framework

Risk avoidance should not exist in isolation. Instead, it should be part of a broader, holistic risk management framework. At DumpsQueen, we believe that successful certification candidates—and effective IT professionals—understand the strategic value of combining multiple risk responses. This means integrating risk avoidance with mitigation strategies, contingency plans, insurance coverage, and ongoing risk assessments. Tools such as SWOT analysis, impact assessments, and root cause analysis help determine when avoidance is the best course of action. Additionally, risk appetite statements and organizational values play a crucial role in shaping these decisions.

Risk Avoidance and Compliance Standards

Risk avoidance is often required to comply with regulatory standards. For instance, under GDPR, companies are expected to avoid practices that could lead to data breaches or unauthorized access. If an activity like sharing customer data with an unverified third partyposes a risk to data privacy, avoiding that activity is not just recommended but legally mandated. In the healthcare industry, HIPAA requires organizations to avoid any processes that could result in unauthorized exposure of patient information. Failure to avoid such risks can lead to hefty fines and damage to organizational credibility.

Preparing for Certifications: Why Risk Avoidance Matters

For IT professionals preparing for certification exams, especially in security, project management, or networking, understanding risk avoidance is essential. Certifications like CompTIA Security+, CISSP, PMP, and others frequently test candidates on risk response strategies. At DumpsQueen, we provide comprehensive study materials and up-to-date question banks that cover these vital concepts. By mastering risk avoidance, you’ll not only perform better on your exams you’ll also enhance your decision-making capabilities in real-world IT environments.

Free Sample Questions

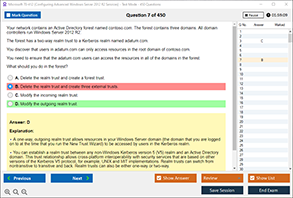

1. Which risk management plan involves discontinuing an activity that creates a risk?

A. Risk Transfer

B. Risk Mitigation

C. Risk Acceptance

D. Risk Avoidance

Answer: D. Risk Avoidance

2. A company decides not to enter a new market due to political instability. What type of risk management is this?

A. Mitigation

B. Avoidance

C. Transfer

D. Retention

Answer: B. Avoidance

3. Which of the following is the best example of risk avoidance?

A. Buying insurance for a data center

B. Encrypting sensitive data

C. Shutting down an insecure application permanently

D. Hiring a cybersecurity consultant

Answer: C. Shutting down an insecure application permanently

4. In a project planning meeting, the team decides to remove a risky feature from the development plan altogether. This is an example of:

A. Risk Acceptance

B. Risk Mitigation

C. Risk Avoidance

D. Risk Monitoring

Answer: C. Risk Avoidance

Conclusion

Risk avoidance is a powerful, proactive approach to managing threats, especially in high-stakes environments where the consequences of failure are severe. It answers the question at the heart of this article “which risk management plan involves discontinuing an activity that creates a risk?” with clarity and conviction. At DumpsQueen, we believe that success in both certification and real-world implementation hinges on understanding strategies like risk avoidance. Whether you're preparing for your next IT exam or making decisions in a leadership role, knowing when and how to avoid risk can safeguard your organization and position you for long-term success. Let DumpsQueen help you master these core concepts with our expertly crafted practice questions, study guides, and professional blogs. Risk may be inevitable but with the right knowledge, it can be effectively avoided.